The concept of “reasonable compensation” for S Corporation (“S Corp”) owners has long been a contentious area for tax professionals and business owners alike. With the IRS increasingly prioritizing this issue, understanding its nuances has never been more critical. A 2021 report by the Treasury Inspector General for Tax Administration (TIGTA) emphasized that the IRS should crack down on S Corp owners who try to avoid employment taxes by taking little or no compensation. Here’s what you need to know about reasonable compensation and how to ensure compliance.

What is Reasonable Compensation?

According to the IRS, reasonable compensation is what an individual would earn for comparable services in a similar business setting under similar circumstances. To satisfy IRS requirements, the wages paid must be both reasonable and tied directly to the services rendered by the shareholder-employee. The determination of what’s “reasonable” isn’t dependent on the profitability or losses of the S Corp and requires a fair, objective analysis.

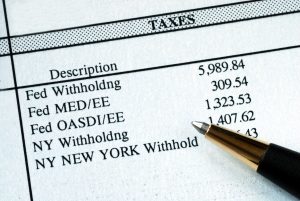

It’s important to note that any S Corp shareholder providing services must be paid wages (reported via a W-2), not treated as an independent contractor (reported via a 1099). This distinction is critical, as misclassification can lead to increased IRS scrutiny, penalties, and interest.

Why is Reasonable Compensation Important for S Corps?

The primary motivation for S Corp owners to minimize wages is to reduce employment taxes. By taking distributions instead of wages, owners avoid paying payroll taxes like Social Security and Medicare. However, the IRS considers this an abuse of the S Corp structure and has increased enforcement efforts to address it.

For tax professionals and business owners, the challenge lies in determining the appropriate level of compensation that does not raise red flags with the IRS. Selecting an arbitrary number or basing it solely on profitability won’t suffice if it’s not well-documented and justifiable.

Cases like Watson v. Commissioner and McAlary Ltd. v. Commissioner have shown how courts assess compensation. These rulings emphasize the importance of sound methodology, peer research, and proper documentation. Without these elements, arbitrary salary amounts are unlikely to hold up under IRS scrutiny.

How to Determine Reasonable Compensation

Navigating the “reasonable compensation” minefield used to be a daunting task. Tax professionals often had to rely on rough estimations, client input, or expensive compensation studies. However, advancements in software and access to robust salary databases have made this process much simpler and more accurate. Here’s how you can approach the issue:

- Conduct Market Research

Use credible data to identify industry-specific salary benchmarks for roles similar to the services performed by the S Corp owner. Tools and databases that provide comprehensive compensation data can help streamline this process and eliminate guesswork. - Document the Methodology

Keep detailed records of how the salary figure was determined. Include comparable salary data, industry reports, and any information about the owner’s roles and responsibilities. Well-documented methodology shows your due diligence and provides a solid defense if audited. - Factor in Multi-Role Contributions

Many S Corp owners wear multiple hats—acting as a CEO, marketer, or accountant. Ensure the compensation reflects these various contributions and responsibilities within the company. - Learn from Court Cases

The Watson and McAlary cases provide valuable insights. They highlight the need for accurate research and stress that credible, well-supported compensation figures are critical for a strong defense against IRS challenges.

IRS Audits of S Corps on the Rise

With the IRS turning up the heat on S Corporations, the need for S Corp owners to get their reasonable compensation right has never been greater. IRS audits targeting payroll taxes are becoming more common, and insufficient or undocumented wages are often a trigger. Avoiding this risk requires a proactive approach to determining compensation—and the guidance of a tax professional can make all the difference.

Key Takeaway

For S Corp owners, striving for “reasonable compensation” isn’t just about staying on the IRS’s good side—it’s about adhering to tax regulations and safeguarding your business from potential penalties. By leveraging tools, research, and sound judgment, you can establish defensible compensation figures.

If you’re a tax professional or S Corp owner unsure of how to determine reasonable compensation, investing in the right tools and guidance is critical. Software solutions are now readily available to make the process easier and fulfill the IRS’s requirements. Proactively addressing the issue today can save you—and your clients—significant headaches tomorrow.

Interested in learning more about handling S Corp audits? With the right training and tools, you can grow your expertise and launch your practice confidently. IRS representation isn’t just an additional service—it’s the gateway to transforming your professional future. Click below and book a call with our team at Tax Rep Network and lets see how we can get you going on your pathway to that $1 million rep practice!

https://calendly.com/kevin-s-mw/trn-intro-call?month=2025-02

Check out the YouTube video with Eric here: Tax Rep Network YouTube