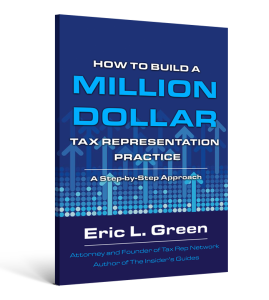

How did we build a $5 million firm? What do I advise my Tax Rep members to do in order to hit that $1 million revenue mark?

The process for building a $1 million Tax Rep firm is not hard to understand, if not easy to do. In this entry I will lay out the 8 steps to follow that I advise anyone who wants to take their practice to the next level.

- Identify Want You Want

It can be difficult sometimes to know what you want. It was for me.

As I explained in the opening of my book How to Build a $1 Million Tax Rep Practice, it was a Sunday about five years ago, and I was in the office as always, miserable, when I spoke with a friend of mine, Brent Robertson. Brent is one of the founders of Fathom, which is a consulting outfit in West Hartford, Connecticut where they do marketing and problem-solving for many companies and entrepreneurs. He easily recognized my unhappiness. “What’s up?” he asked in his usual cheery way.

“I need to ask you something,” I started, “The firm is great, growing every day. Tax Rep keeps growing. The podcast following keeps growing. My wife and kids are great. So why am I so miserable?”

“Ahhh,” he started, “Well, tell me what you want.”

“What do you mean?”

“I mean,” Brent said, “describe to me what you want your day, week and month to look like. Walk me through that.”

I couldn’t.

“Well, until you know what you want, it will be hard for anyone to help you, and for you to know which steps to take.” Brent said. “Can I suggest we meet for coffee next week, and meanwhile you need to think about what you want your life and practice to be, and then we can engineer how to make that happen.”

And that is exactly what we did. Brent had me lay out my goals. We figured out what I needed to do, step-by-step, to reach those goals, and then we began implementing the process.

- Engineer Backwards

How many clients do you need to get? How much will you be charging for each service? It helps to get somewhere if you know where you are going.

Let’s say you have a tax preparation and accounting practice now which brings in $350,000 in revenue. We would need to add another $650,000 of business. Now figure out what services you want to Offer (see Step # 3 below) and begin doing the math to figure out how many new clients you need to get each month. Put together your marketing/networking plan (see Step #6 below) and start executing.

- What Services Do You Want to Offer

What services should you offer? Its easy – what do you enjoy doing? It makes no sense to offer a service you don’t like providing. So don’t.

If you like accounting and numbers, focus on audits and forensic reconstruction of records. If you find innocent spouse cases fascinating, then focus on those cases (and market to Family Law/Divorce attorneys). Life is too short to be stuck doing something you hate, so focus on finding the types of cases you like.

- Leverage Technology

The way to get work done efficiently and make more money is to leverage technology.

We leverage technology as much as possible. If there is a way to aotmate something, we do it. Our current technology stack includes:

- Anchor, to get our agreements signed and paid. If the potential client doesn’t sign immediately than Anchor will follow-up until they do

- RCReports, for reasonable compensation reports for any S Corporation or C Corporation owners

- NiceJob so that we get those 5-star google reviews from our happy clients

- Tax Help Software for all of our transcripts, resolution forms, and monitoring our clients accounts

- ENQ for calling the IRS and getting through in under 3 minutes

- Deal with Your Existing Practice

If you have an existing practice that is not bringing you joy and profits, we need to decide what to do with it. This is usually when people ask me “Should I get rid of my tax return business?” or “I know, get rid of the bookkeeping…”

I would say neither of those things. The answer is simply “what do you WANT to do with it?”

The big issue is deciding who you want to work with and making sure you are paid properly. You need to review your existing clients, make sure they are paying the correct amount for the work they are receiving, and jettison those that are not worth keeping.

- Finding Clients

Clients are literally everywhere, and chances are you know a bunch who just have not shared they have tax issues. There are currently over 15 million taxpayers that owe back balances to the IRS, and another 10 million non-filers who will almost certainly owe money when the IRS catches up with them.

Inside Tax Rep our members have access to over 40 hours of on-demand training, all of our letters, blogs and material, and we do a live marketing session each month for all the members. We also run the $100,000 challenge to help members quickly get to that first extra $100,000 of income!

Given how many taxpayers are in trouble, the challenge is to make sure everyone knows you handle IRS matters. Nobody can refer you clients if they do not know you handle IRS Rep matters.

- Getting Trained

If you are a former IRS Revenue Officer or trial attorney, and you know how to handle IRS matters, great, you can skip this.

If you are a tax practitioner who may have just dabbled in IRS Representation, knowing what to do is critical.

IRS Representation is not complicated. Trust me.

You want to make sure you have the training, skills and resources necessary to do the job like a pro from start to finish. If we want to bill like a specialist, we must act like a specialist.

At Tax Rep LLC we make you a specialist by providing the top Tax Rep training, and we have your back straight through the entire process!

With over 170 hours of on-demand training and over 60 hours every year of live training, we will turn you into the IRS Rep hero your clients and future clients need, and we support you every step of the way with our live help desk and unlimited consultations.

- Get Up Each Morning and Repeat

Building a $1 million practice is not about being motivated.

Motivation comes and goes. What it does take to build your dream practice is discipline.

This is what separates the successful from the dreamers.

This is not complicated – nothing we do is. It just takes your desire to get there and the discipline to get up and execute the plan. If you do, your only limit will be the one you decide to impose on yourself.